New Fed Rules Will Kill Thrift Banks - Forbes

Jun 11, 2012 . The financial metrics that allowed thrifts to be profitable—high loan-to-deposit ratios, low expenses, and high leverage—are no longer possible .

http://www.forbes.com/sites/halahtouryalai/2012/06/11/new-fed-rules-will-kill-thrift-banks-kbw-says/

Deposits-to-loan ratio plunges to new low - FierceFinance

4 days ago . Deposits-to-loan ratio plunges to new low . Fitch Downgrades 8 Classes of CGCMT 2006-C4 · Wells Fargo Reports 792,602 Active Trial and .

http://www.fiercefinance.com/story/deposits-loan-ratio-plunges-new-low/2012-09-14

JPMorgan loss shows risks in safe-haven banks | Reuters

May 15, 2012 . In the United States and Europe, the picture is mixed. Wells Fargo's last customer loans-to-deposits ratio was 88 percent, while HSBC's was 75 .

http://www.reuters.com/article/2012/05/15/us-jpmorgan-cio-idUSBRE84E0KQ20120515

Wells Fargo Bank Reviews and Rates - DepositAccounts.com

Wells Fargo Bank is headquartered in Sioux Falls and is the 2nd largest bank . 4 /30 - Wells Fargo Won't Let Man Access His Safe Deposit Box, He Misses His .

http://www.depositaccounts.com/banks/wells-fargo-bank.html

Banks Want to Lend, but No One Wants to Borrow - TheStreet

Jun 24, 2011 . The large banks are certainly well -capitalized to make loans. . Over the same period, Wells Fargo's (WFC)ratio of loans to deposits dropped to .

http://www.thestreet.com/story/11163927/1/banks-want-to-lend-but-no-one-wants-to-borrow.html

Work From Home Jobs

- car wraps san antonio tx

- zambia institute banking finance services

- john parker insurance zanesville ohio

- keystone innovation zone credit

- tim sale spider-man blue

- watch knocked up online free

Copyright Andres Balcazar

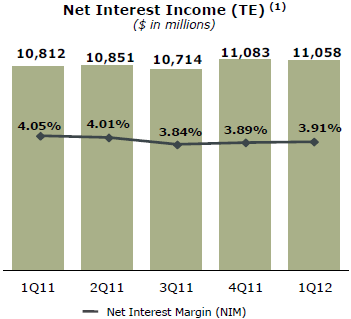

fourth quarter 2011 earnings release - Wells Fargo

Jan 17, 2012 . Tier 1 common equity ratio estimated at 7.49 percent3 . quarter growth in loans, deposits and capital, and continued strong credit quality,” said .

https://www.wellsfargo.com/downloads/pdf/press/4q11pr.pdf

thanks very much for the information

Loan-To-Deposit Ratio | ZeroHedge

European banks already have the highest loan-to-deposit loan-to-deposit ratio in the world. This means they are massively more levered, roughly 3x more, the .

http://www.zerohedge.com/taxonomy/term/9091

Banco Santander: Tantalizing Value Or High-Risk Investing ...

Apr 24, 2012 . These performance and valuation ratios also compare well to the . BBVA and the major U.S banks, with Wells Fargo, JPMorgan and Citigroup all . The bank has a group wide loan to deposit ratio of 117%, which is 24 .

http://seekingalpha.com/article/523021-banco-santander-tantalizing-value-or-high-risk-investing