Home Buying: Can PMI be based on assessed value to loan amount ...

Aug 5, 2010 . If you buy it for more than appraised value, is is safer for the lender to assume . Loan to value is determined by the lesser of the selling price or .

http://www.trulia.com/voices/Home_Buying/Can_PMI_be_based_on_assessed_value_to_loan_amount_-236421

LTV

The value portion of the Loan to Value equation is determined by the lower of the purchase price or appraised value when you are buying a home. The most .

http://www.goodmortgage.com/Learn/Terms/LTV.html

What Is the Down Payment? - The Mortgage Professor

. payment is the lower of sale price and appraised value less the loan amount. . I put 20% down -- $48,000 on a $240,000 home purchase – but I'm told that I .

http://www.mtgprofessor.com/A%20-%20Down%20Payment/what_is_the_down_payment.htm

A Loan To Value Ratio Defined

The lender tells the couple that it can loan up to an 80% loan to value on the purchase price or the appraised value of the home the couple is looking to .

http://qna.mortgagenewsdaily.com/questions/a-loan-to-value-ratio-defined

Up to 102% LTV / .3% ANNUAL FEE ... - USDA Rural Development

Not limited to lower of appraised value or purchase price. Customary closing costs and repairs can be financed up to the appraised value. Loan amount can .

http://www.rurdev.usda.gov/SupportDocuments/MO-GRH-FactSheet_02-2012.pdf

Work From Home Jobs

- when did quartz watches come out

- zales diamond watches

- buy yacht ottawa

- mortgage debenture wiki

- used laptops on sale in toronto

- mortgage qualification limits

Copyright Andres Balcazar

High loan to value, California hard money loans

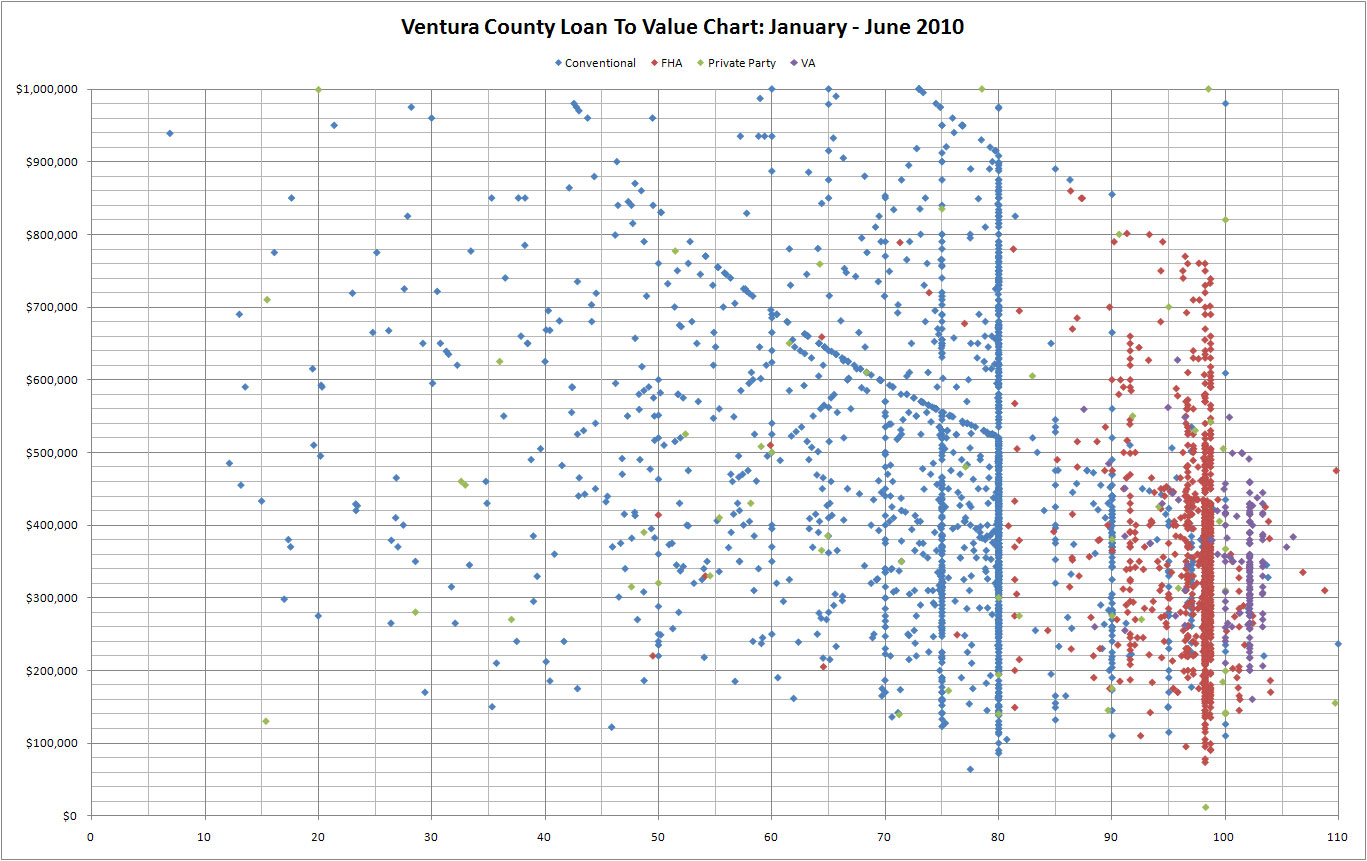

80% LTV. County: Los Angeles. "As-Is" Value: $675,000. Purchase Price: $610,000. Term: . High LTV hard money based on the purchase price only. No fund .

http://www.vanguardhardmoney.com/loans/recent_fundings_purchase_price.aspx

thanks very much for the information

Loan-to-value ratio - Wikipedia, the free encyclopedia

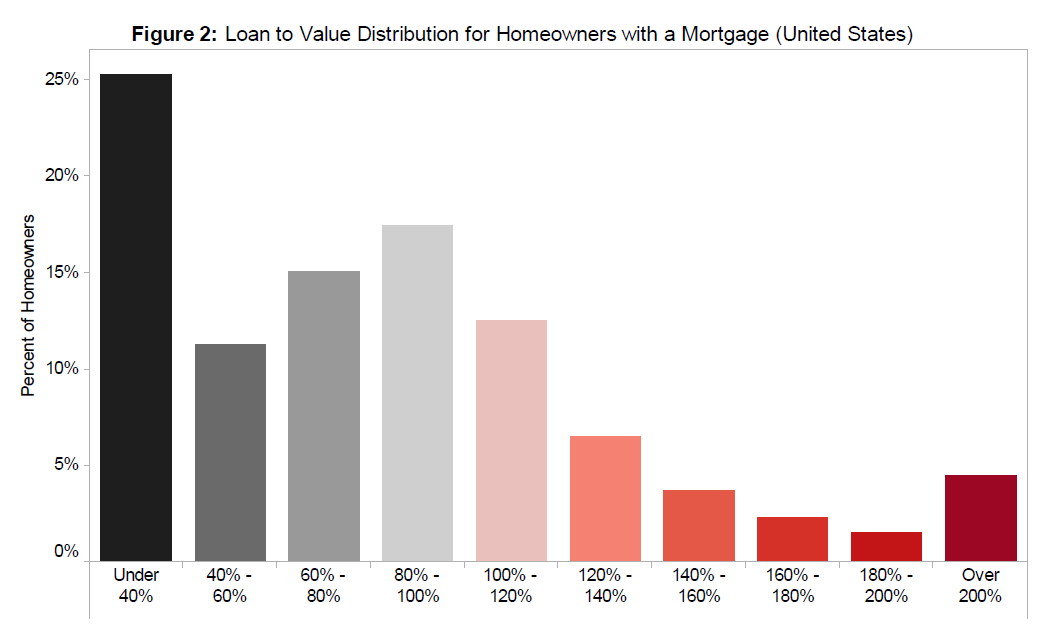

Lenders can require borrowers of high LTV loans to buy mortgage insurance to protect the lender from the buyer default, which increases the costs of the .

http://en.wikipedia.org/wiki/Loan-to-value_ratio

How LTV and CLTV Will Affect Your New Home Loan - Loan Page

Basically, your mortgage lender will add up all liens on the property before dividing by the purchase price. Combined Loan-To-Value: The Big Picture .

http://www.loanpage.com/articles-and-advice/new-home-loan/how-ltv-and-cltv-will-affect-your-new-home-loan.aspx